SMCI Stock Split: Understanding the Impact and Opportunities

The term smci stock split has been circulating widely in trading discussions, sparking curiosity among seasoned investors and those just stepping into the world of equities. When a company like SMCI decides to split its stock, it’s not just a technical maneuver it can be a signal, a market statement, and sometimes even a confidence boost to shareholders. While on the surface, a smci stock split might look like a straightforward adjustment of share counts, its effects ripple through investor perception, market activity, and the brand’s positioning in the competitive tech landscape.

Understanding the SMCI stock split requires more than just glancing at a price chart. It calls for a deeper dive into why the company might pursue such a move, how it aligns with broader market trends, and what it might mean for the strategic path forward. This is not merely about slicing up shares it’s about accessibility, liquidity, and the subtle psychology that drives both retail and institutional players to act.

The Basics Behind the SMCI Stock Split

At its core, a SMCI stock split is a restructuring of how shares are presented to the market. Instead of altering the intrinsic value of the business, the company adjusts the share count in a way that changes the price per share while keeping the overall market capitalization the same. For many investors, this makes shares feel more approachable, especially if they previously carried a high price tag that deterred smaller buyers.

When SMCI chooses to execute a stock split, it is often interpreted as a message. The company might be signaling that its growth has pushed the share price to a level where a split would make it more liquid and accessible. This is especially relevant in the tech sector, where investor enthusiasm can drive valuations upward in rapid bursts. By opting for an SMCI stock split, the leadership acknowledges the need to balance prestige with inclusivity, ensuring that new investors can enter without feeling priced out.

Why Companies Like SMCI Pursue a Stock Split

One of the primary reasons for a SMCI stock split is investor accessibility. A high share price can sometimes act as a psychological barrier. While seasoned traders understand that a stock’s price alone doesn’t determine its value, newer investors may shy away from shares that seem “too expensive” on the surface. Splitting the stock makes it appear more affordable, potentially widening the pool of interested buyers.

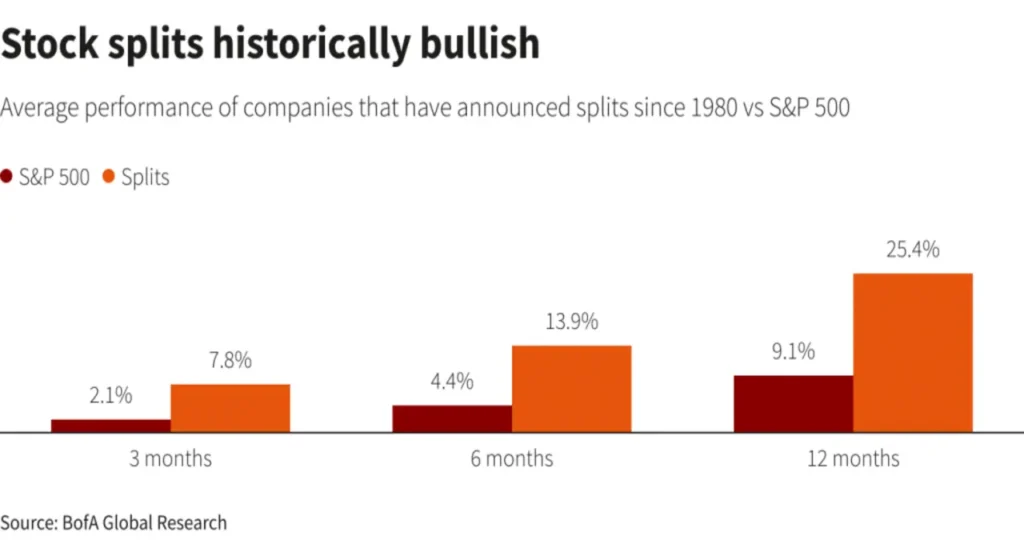

Another reason could be market momentum. A smci stock split can spark renewed interest in the stock, even from those who have been watching from the sidelines. When a well-regarded company announces a split, it often generates media attention, increased trading volumes, and, in some cases, a short-term rally as excitement builds. This is not guaranteed, of course, but it’s a well-observed phenomenon in many past corporate actions across industries.

Investor Psychology and the SMCI Stock Split

The psychology behind a SMCI stock split is fascinating. Humans are wired to respond to perceived bargains, and a lower per-share price can trigger the feeling of catching an opportunity at a “discount.” Even though the actual value of an investor’s holdings doesn’t change immediately after the split, the perception shift can drive more market activity.

For long-term investors, a SMCI stock split can feel like a milestone. It’s a tangible sign that the company’s journey has brought it to a stage where management believes its stock price is strong enough to merit division. For short-term traders, it may present a tactical opportunity, as splits often bring increased liquidity and shorter bid-ask spreads, making it easier to execute large trades quickly.

SMCI’s Position in the Tech Market and Its Relation to the Stock Split

SMCI operates in an industry where innovation cycles move quickly, and competition is fierce. The decision to initiate a SMCI stock split could be part of a broader strategy to maintain visibility and attractiveness in a crowded field. Tech investors tend to follow sentiment trends closely, and a split can serve as a timely reminder of the company’s growth trajectory and market relevance.

By conducting a stock split, the company may also be appealing to index funds or ETFs that base their holdings on share counts or liquidity factors. Increasing the number of shares without diluting value can make SMCI more accessible to such funds, potentially broadening the base of long-term institutional ownership.