Rivian Stock Forecast Automotive Inc. (NASDAQ: RIVN) has been a focal point in the electric vehicle (EV) sector since its public debut in 2021. As the company continues to scale its operations and expand its product lineup, investors and analysts are closely monitoring its stock performance and prospects. This article delves into Rivian’s current stock outlook, key drivers influencing its valuation, and expert forecasts for the coming years.

Rivian Stock Forecast Understanding Rivian’s Market Position

Rivian entered the EV market with a bold vision: to produce adventure-ready electric vehicles that cater to outdoor enthusiasts. The company’s flagship models, the R1T pickup truck and the R1S SUV garnered significant attention for their rugged design and impressive performance capabilities. In addition to these consumer vehicles, Rivian has secured contracts to supply electric delivery vans to major companies like Amazon, further diversifying its revenue streams.

Despite these promising developments, Rivian faces intense competition from established automakers and other EV startups. Companies like Tesla, Ford, and General Motors have ramped up their EV offerings, increasing pressure on Rivian to maintain its market share. Furthermore, the broader economic environment, including interest rates and supply chain challenges, adds complexity to Rivian’s growth trajectory.

Financial Performance and Stock Analysis

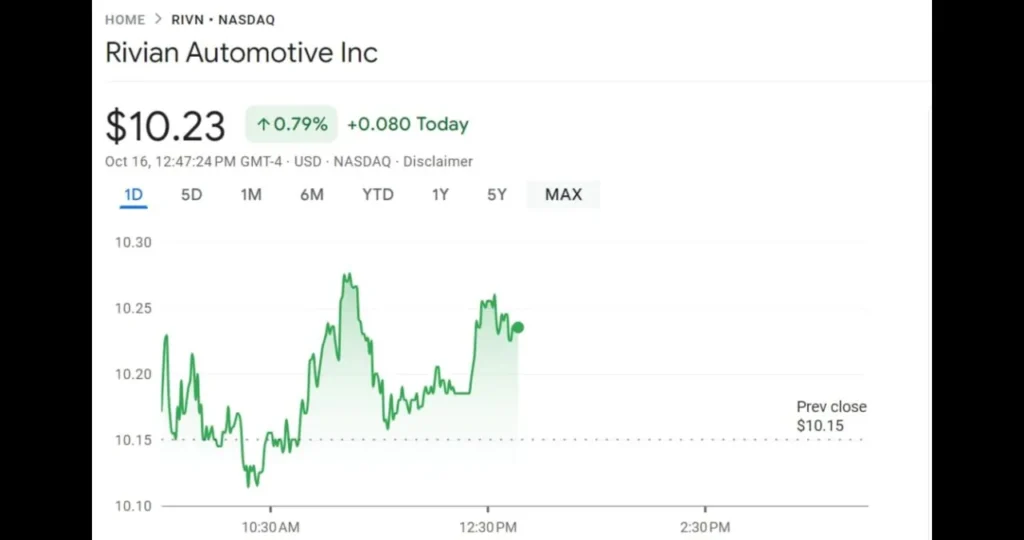

As of June 16, 2025, Rivian’s stock is trading at $13.42, reflecting a decline of approximately 3.5% from the previous close. This downturn follows recent downgrades from prominent analysts, citing concerns over slowing EV demand and potential policy shifts that could impact federal incentives for electric vehicles. For instance, Bank of America downgraded Rivian’s stock from “neutral” to “underperform,” reducing its price target from $13 to $10, attributing the downgrade to weakening demand and potential adverse impacts from policy changes. Despite these challenges, Rivian reported its first quarterly gross profit of $140 million, signaling progress toward achieving profitability. The company ended 2024 with approximately $9 billion in cash and liquidity, providing a solid financial foundation to navigate upcoming hurdles.

Strategic Initiatives and Growth Prospects

Joint Venture with Volkswagen

In a significant move to bolster its technological capabilities, Rivian announced a joint venture with Volkswagen Group Technologies in 2024. The partnership aims to develop a new software-defined vehicle platform, combining Rivian’s software expertise with Volkswagen’s manufacturing experience. This collaboration is expected to reduce production costs and enhance competitiveness in the EV market

Introduction of the R2 Platform

Looking ahead, Rivian plans to launch its R2 platform in 2026, targeting a more affordable segment of the EV market. The R2 vehicles will feature advanced battery technology, including LG Energy Solution’s 4695 cylindrical cells, offering improved energy density and thermal management. This strategic move aims to broaden Rivian’s customer base and drive volume growth.

Analyst Forecasts and Price Targets

Analysts have varying outlooks on Rivian’s stock performance. According to 24/7 Wall St., Wall Street analysts have set a price target of $17.54 for Rivian’s stock over the next year, indicating a potential upside of approximately 66.9% from the current price. The firm anticipates strong revenue growth of 60% in 2025, driven by the introduction of the R2 platform and increased vehicle deliveries

Conversely, some analysts expressed caution due to short-term challenges. For example, Piper Sandler downgraded Rivian Stock Forecast from “Buy” to “Hold,” citing delayed payoffs and anticipated difficulties in achieving profitability in the near term

Risks and Considerations

Investors should be aware of several factors that could impact Rivian’s stock performance:

- Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share.

- Policy Changes: Shifts in government policies, such as the potential removal of the $7,500 federal tax credit, could affect consumer demand for electric vehicles.

- Supply Chain Challenges: Ongoing supply chain issues could hinder Rivian’s production capabilities and delivery timelines.

Conclusion

Rivian’s journey as a publicly traded company has been marked by significant milestones and challenges. While the company has made strides toward profitability and secured strategic partnerships to enhance its technological capabilities, it faces a competitive and dynamic market environment. Investors should carefully consider the potential risks and rewards associated with Rivian’s stock, keeping an eye on key developments such as the launch of the R2 platform and the outcomes of its joint venture with Volkswagen.

FAQs

1. What is Rivian’s current stock price?

As of June 16, 2025, Rivian’s stock is trading at $13.42.

2. What are the key factors influencing Rivian’s stock forecast?

Key factors include the launch of the R2 platform, the joint venture with Volkswagen, competition in the EV market, and potential policy changes affecting electric vehicle incentives.

3. How does Rivian’s financial position compare to its competitors?

Rivian ended 2024 with approximately $9 billion in cash and liquidity, providing a solid financial foundation to navigate upcoming challenges.

4. What are analysts’ price targets for Rivian’s stock?

Analysts have set a price target of $17.54 for Rivian’s stock over the next year, indicating a potential upside of approximately 66.9% from the current price.

5. What are the risks associated with investing in Rivian?

Risks include increasing competition in the EV market, potential policy changes affecting electric vehicle incentives, and ongoing supply chain challenges.

Quick Bio Table

| Attribute | Details |

| Company Name | Rivian Automotive Inc |

| Ticker Symbol | RIVN |

| Industry | Electric Vehicles |

| Founded | 2009 |

| Headquarters | Irvine, California, USA |

| CEO | RJ Scaringe |

| Flagship Models | R1T, R1S |

| Strategic Partners | Amazon, Ford, Volkswagen |

| 2024 Revenue | Approximately $2.5 billion |

| 2024 Deliveries | Approximately 52,000 units |