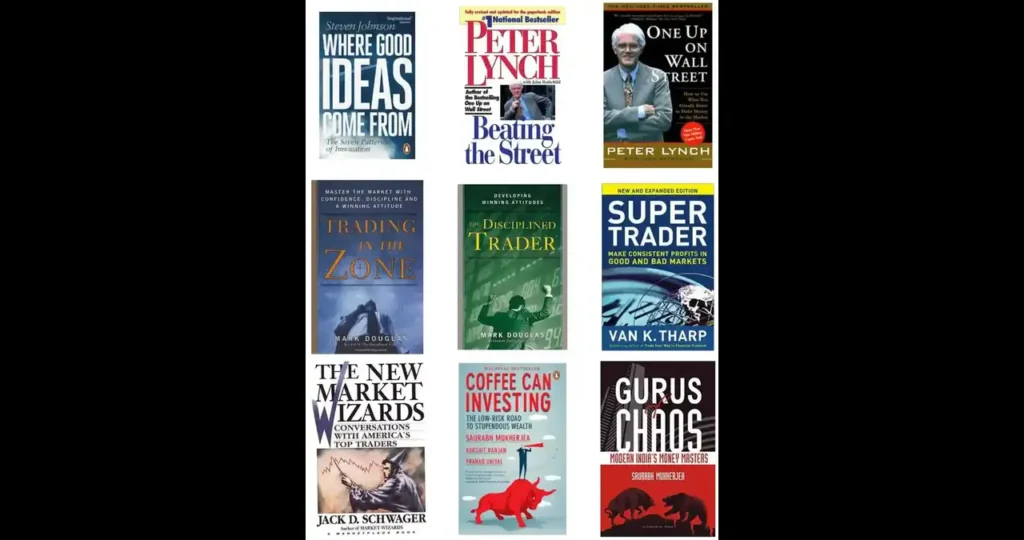

Best Stock Market Books Whether you’re a complete newbie or have been watching the tickers for a while, having a strong foundation in stock market knowledge can be a real game-changer. One of the best ways to gain that solid ground is by reading the best stock market books. These aren’t your average dry textbooks either. Many are written with wit, insight, and wisdom—designed not just to inform but to transform the way you think about investing truly.

The beauty of diving into stock market literature is that you get access to the minds of the greatest investors, analysts, and thinkers who’ve lived through booms and busts. You get to skip the trial and error (and potential financial pain) by learning from their experiences. So, let’s talk about some of the best stock market books that you should consider adding to your reading list if you’re serious about becoming a savvy investor.

Why Read Stock Market Books Anyway?

Let’s be real—there’s a flood of content online about investing. Blogs, videos, forums, social media gurus. So why bother with a book? Books offer something that bite-sized content often can’t: depth, structure, and credibility. When someone writes a book, they usually spend years distilling their insights, compiling data, and weaving in personal anecdotes that help drive the message home.

Reading a well-crafted stock market book is like having a mentor guide you step-by-step. You’re not just getting scattered tips—you’re getting a comprehensive view of how to think, plan, and execute investment strategies. And that’s worth every minute you spend flipping those pages.

Books also help in cutting through the noise. Unlike social media hype or sensational headlines, the best stock market books give you timeless principles. These are truths that have stood the test of time and market cycles. Whether the market is soaring or crashing, these principles remain relevant.

The Classics That Never Get Old

When you talk about the best stock market books, you can’t ignore the classics. These are the heavy hitters that have influenced generations of investors. They might not have flashy covers or trendy titles, but their content is gold.

Take “The Intelligent Investor” by Benjamin Graham. This book is like the holy grail of value investing. Graham’s idea of investing with a margin of safety and focusing on intrinsic value changed the investing world forever. It’s a book that Warren Buffett swears by—and if it’s good enough for him, it’s probably worth your time.

Then there’s “Common Stocks and Uncommon Profits” by Philip Fisher. Fisher digs into the qualitative side of investing, like evaluating a company’s management and innovation potential. His work complements Graham’s numbers-heavy approach perfectly, offering a well-rounded perspective.

These classics are not just educational—they shape your mindset. They force you to look beyond the price chart and consider the business behind the stock symbol.

Modern Must-Reads for Today’s Market

As investing evolves, so does the literature around it. While the classics build your foundation, modern books offer a lens into today’s dynamic market environment. If you want to keep up with algorithmic trading, ETFs, global market trends, and behavioral finance, you’ll need to add a few newer titles to your library.

Books like “A Random Walk Down Wall Street” by Burton Malkiel bring you up to speed on index investing and efficient market theory. It’s practical and, more importantly, updated regularly to reflect current market scenarios. Malkiel doesn’t just teach you how to invest—he challenges many of the assumptions that new investors bring to the table.

“The Little Book That Still Beats the Market” by Joel Greenblatt is another gem. It’s simple, straightforward, and incredibly effective in explaining how to find quality stocks at bargain prices. Greenblatt’s “Magic Formula” investing strategy is a great tool for anyone who wants a disciplined approach to stock picking.

Books That Teach the Psychology of Investing

Stock market success isn’t just about picking winners—it’s about mastering your own emotions. This is where the psychology of investing comes into play, and thankfully, some brilliant books cover this vital aspect.

“Thinking, Fast and Slow” by Daniel Kahneman is not specifically a stock market book, but its insights into human decision-making are invaluable for any investor. Understanding how your brain processes risk, loss, and reward can help you avoid costly mistakes.

“The Psychology of Money” by Morgan Housel is another must-read. It breaks down the emotional and behavioral aspects of personal finance and investing in a way that’s relatable and memorable. Housel’s stories stay with you and change how you view wealth and risk.

These books remind us that investing is as Best Stock Market Books about temperament as it is about knowledge. They teach you to stay calm in the storm, resist the urge to follow the herd and keep your eyes on the long-term goal.

For the Technical Analysis Enthusiast

Not everyone wants to pore over income statements and balance sheets. Some traders prefer charts, patterns, and indicators. If that’s more your speed, there are stock market books tailored just for you.

“Technical Analysis of the Financial Markets” by John Murphy is the go-to guide for anyone interested in technical trading. It covers everything from chart patterns to momentum indicators, and it does so in a clear, accessible way. Even if you’re new to the technical side of things, Murphy’s book is a great place to start.

Another fantastic read is “How to Make Money in Stocks” by William J. O’Neil. This one combines both technical and fundamental approaches, and it introduces the CAN SLIM strategy that has helped many investors achieve impressive results. O’Neil also uses lots of real-world examples, making it easier to apply the concepts to your investing.

Technical analysis books are like user manuals for navigating price trends. They may not be for everyone, but for those who thrive on market patterns and timing, they’re invaluable.

Biographies and Stories of Legendary Investors

Sometimes, the best way to learn is through stories. And what better stories than those of legendary investors who’ve built fortunes, weathered storms, and made a lasting impact on the market?

“Snowball: Warren Buffett and the Business of Life” by Alice Schroeder gives you an in-depth look into the life and mind of one of the most successful investors of all time. It’s not just about stocks—it’s about Buffett’s philosophy, discipline, and the way he views business and life.

“Market Wizards” by Jack D. Schwager is another inspiring read. It’s a series of interviews with top traders who share their strategies, failures, and lessons learned. You’ll find a mix of styles—from day traders to long-term investors—and each one offers unique insights.

These stories humanize the stock market. They show that behind every trade, and every strategy, there’s a person with instincts, habits, and a relentless desire to grow.

Books That Break Down Complex Concepts

Let’s face it—some stock market concepts can be intimidating. But the right book can turn a confusing topic into an “Aha!” moment. These books don’t just explain—they simplify and demystify.

“The Bogleheads’ Guide to Investing” is a fantastic example. Inspired by Vanguard founder Jack Bogle, this book makes investing in index funds accessible to everyone. It’s friendly, fun, and incredibly informative.

“One Up on Wall Street” by Peter Lynch is another approachable classic. Lynch talks about using everyday observations to identify investment opportunities before they hit Wall Street’s radar. It’s a refreshing take that encourages you to trust your instincts—backed by solid research, of course.

Simplifying doesn’t mean dumbing down. It means making investing understandable for everyone—from the college student saving their first $100 to the retiree managing a nest egg.

Books for Long-Term Investors

If you’re in it for the long haul, you need books that focus on sustainable investing strategies. These titles emphasize patience, consistency, and resilience—the core traits of every successful long-term investor.

“The Long-Term Investor” by Jeremy Siegel is a cornerstone in this category. It provides a historical perspective on market returns, inflation, and economic cycles. Siegel’s research proves that long-term investing in stocks has consistently outperformed other asset classes.

Another great pick is “Unshakeable” by Tony Robbins. Robbins interviews top investors and distills their wisdom into practical steps. His focus on staying calm during downturns and sticking to your strategy is a message every long-term investor needs to hear.

Long-term investing books help you build wealth without losing sleep. They reinforce the idea that investing isn’t about getting rich quick—it’s about getting rich smart.

Books That Dive into Dividend Investing

Dividend investing is often overlooked, but it’s a powerful strategy for generating passive income. Some of the best stock market books specialize in teaching how to build a portfolio that pays you back consistently.

“The Little Book of Big Dividends” by Charles B. Carlson is a standout here. It teaches you how to evaluate dividend-paying companies and build a portfolio that grows both in income and value.

“Get Rich with Dividends” by Marc Lichtenfeld is another essential read. It lays out a 10-11-12 system that targets annual income increases, capital appreciation, and reduced risk. It’s a smart, sustainable approach that appeals to both beginners and seasoned investors.

Dividend investing books are all about building wealth that works for you. They show that consistent, compounding income can be just as powerful as capital gains.

Books That Focus on Risk Management

Risk is an unavoidable part of investing, but managing it smartly can make all the difference. Some of the most valuable stock market books dive deep into how to assess, understand, and mitigate risk.

“Against the Gods: The Remarkable Story of Risk” by Peter L. Bernstein is a historical and analytical deep dive into risk management. It’s rich with stories and insights that link mathematical theories with real-world market applications.

“Fooled by Randomness” by Nassim Nicholas Taleb explores the role of luck and probability in financial markets. It teaches you to be cautious of overconfidence and to respect the role of chance in investment outcomes.

These books are crucial because they protect you from blind spots. They help you build strategies that not only aim for reward but also withstand volatility.

Final Thoughts: Build Your Investing Bookshelf Wisely

Choosing the best stock market books is a personal journey. Your interests, goals, and level of experience will shape your reading list. Start with a few that match your current needs, and then branch out. Blend the classics with modern insights, theory with practice, and data with emotion.

The most successful investors never stop learning. They treat books as tools—each one adding another layer to their knowledge and confidence. And the more you read, the more you’ll realize that successful investing isn’t about chasing trends—it’s about mastering principles and sticking to them.

So grab a cup of coffee, open up one of these amazing titles, and get ready to see the stock market with fresh eyes. Because sometimes, the best investment you can make is in your education.